The Insane Hidden Tax Burden Quietly Eating up Your Paycheck

There are few things I dislike more than paying taxes. As Americans, a third of all your hard earned dollars is confiscated by the U.S. government. Most of us get to determine what we do with our money – but not when it comes to taxes.

However, there is the argument that taxes are a function of our democratic system. Those taxes are the result of laws implemented by freely elected representatives. If anything, we — the voters — are as much to blame for the muddied tax codes as are the nitwit politicians we elect.

But not all taxes feel Constitutional, and not all taxes are the result of our representative government — particularly the taxes paid in the form of regulatory costs. Regulations increase the cost of everything — including the cost of our housing, clothing and food. In fact, they even impact our wages. What makes this form of tax so nefarious is that rarely do our elected representatives get to have a say in the matter; rather, America’s regulatory state is overseen by an authoritarian administrative state, ruled by unelected bureaucrats.

Nobel Prize economist, F.A. Hayek lamented the dangers of these unelected bureaucrats, which he called the “public administration movement,” in his book The Constitution of Liberty. Hayek believed these bureaucrats were often antagonistic, if not ignorant of, the rule of law, directing “[T]heir heaviest attacks against the traditional safeguards of individual liberty, such as the rule of law, constitutional restraints, judicial review and the conception of a “fundamental law.””

These bureaucrats have designed a labyrinth of rules and regulations that silently consume our life, and our paychecks, with little repercussion or accountability. Bureaucrats don’t follow laws, they make them. If you don’t like some new Washington regulation – too bad.

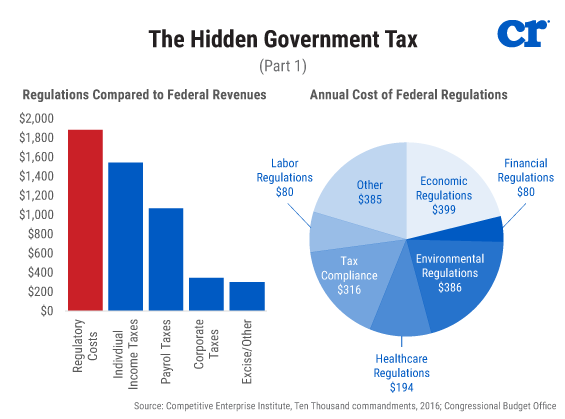

Recently, the Competitive Enterprise Institute (CEI) released a regulatory study called Ten Thousand Commandments that analyzed the cost of regulations. The report finds that federal regulations cost the U.S. economy over $1.9 trillion. To put that into perspective, if you add up the federal income taxes we pay, or $1.62 trillion, our regulatory tax is nearly $300 billion more!

For most of us, the word “trillions” is often left out of your every day vernacular. But we shouldn’t be naïve to the punitive burden this cost levies on each American. CEI helps illustrate the severity of that burden. They took the total regulatory costs in the U.S. and compared them to the entire economies of other countries.

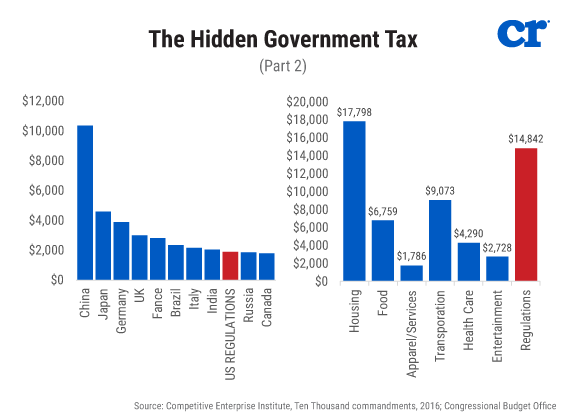

The results show that if U.S. regulations were its own country, it would rank ninth in the world. That means Americans face a regulatory burden that is just behind the entire economy of India, but larger than all the productivity of Russia.

Economic thinking ultimately assumes these costs get passed onto individuals and consumers – you! Therefore, CEI analyzed the regulatory burden for each individual U.S. household. In doing so, they determined the “cost” to each household was $14,842 per year. That is roughly 22 percent of the average income in the United States.

CEI also demonstrates how this impacts the family budget. In the U.S., housing is the costliest expense to each household. After that, you would think it was food or clothing, perhaps transportation and health care. But you would be wrong; instead it is regulations.

Most troubling is the the nature of our regulatory system. They are designed by rogue and unelected bureaucrats. Regulations effectively become laws with little oversight or accountability.

This isn’t a small problem. Take for example your elected representatives in Congress. In 2015, CEI finds that Congress enacted 114 laws (that’s probably too many). However, unelected bureaucrats issued 3,410 rules in that same year. In other words, the “fourth” branch of government that is unaccountable issued 30 regulatory decrees for every one law passed by Congress. That’s simply insane.

In total, there are 178,277 pages in the Code of Federal Regulations which outline the 94,000 rules currently on the books. The cost to enforce all these regulations comes at a massive price. CEI finds that federal agencies spent $63 billion in taxpayer dollars to administer and police this regulatory enterprise.

As bad as this seems, it’s about to get worse. There are currently 3,297 new regulations in the implementation phase. Of this total, CEI finds that 218 are considered “economically significant,” a definition the government uses when a regulation will have an economic impact of $100 million or more.

The hidden regulatory tax is becoming dangerous to American democracy. The regulatory apparatus is out of control. Over the past 23 years, the number of regulations has increased by 2,060 percent. Individuals that are not elected, or confirmed by elected representatives, should not have such great authority and power over our lives.

The idea of living in a constitutional republic ruled by an unaccountable administrative state is an oxymoron. Nowhere in the Constitution are administrative agencies granted legislative privilege to create rules and enforce them by limiting the people’s rights and liberties, or to exact taxes upon the populace.

It’s time we take back our government from bureaucrats; it’s time we put an end to this crushing hidden tax. (For more from the author of “The Insane Hidden Tax Burden Quietly Eating up Your Paycheck” please click HERE)

Follow Joe Miller on Twitter HERE and Facebook HERE.